are withdrawals from a 457 plan taxable

Beneficiary distributions avoid the early withdrawal penalty of 10 percent. However distributions from a ROTH 457 plan are not subject to tax withholding.

How To Access Retirement Funds Early

You can choose to cash out the plan start a series of regular.

. Earnings on the retirement money are tax-deferred. For this calculation we assume that all contributions to the retirement account. Are distributions from a state deferred section 457 compensation plan taxable by New York State.

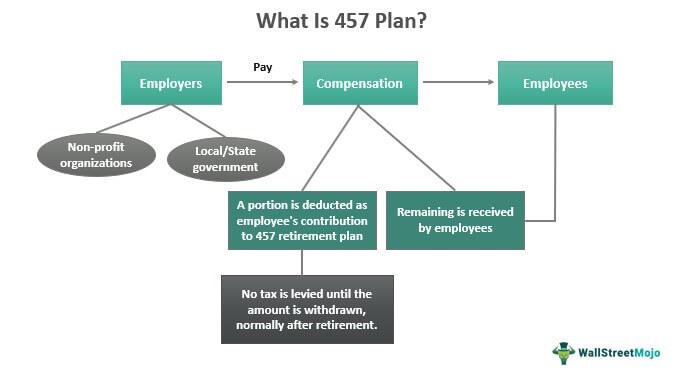

If you have a governmental or non-governmental 457 b plan you can withdraw some or all of your funds upon retirement even if you are not yet 59½ years old. A 457 distribution is still taxable with the IRS technically considering contributions to the plan as remuneration paid. Once you retire or if you leave your job before retirement you can withdraw part or all of the funds in your 457 b plan.

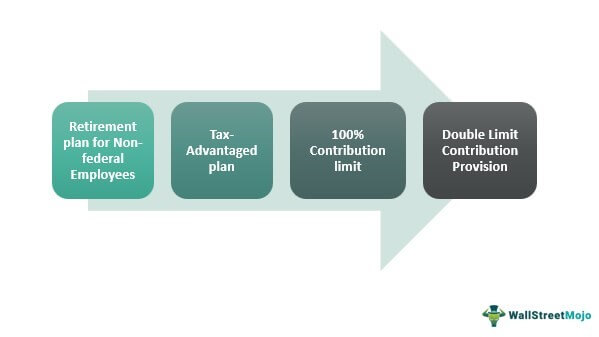

Also 457 plan participants are. A 457 plan is a tax-deferred retirement savings plan. Tax Implications You are permitted to withdraw money from your 457 plan without any penalties from the Internal Revenue Service no matter how old you are.

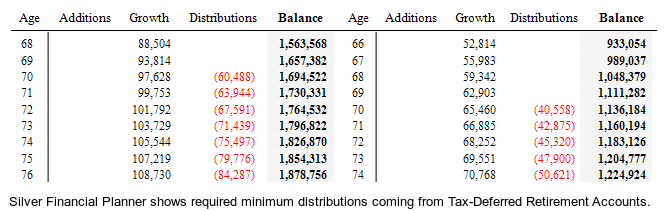

The amount you wish to withdraw from your qualified retirement plan. Funds are withdrawn from an employees income without being taxed and are only taxed upon withdrawal which is typically. Withdrawals from 457 retirement plans are taxed as ordinary income.

5 There is. All money you take out of the account is taxable as ordinary. Can a 457 b plan include designated Roth accounts.

However you will have to pay. If you have a 457 plan and you die your beneficiary can take distributions from the plan immediately. Rollovers to other eligible retirement plans 401 k 403 b governmental 457 b IRAs No.

When you retire or leave your job for any reason youre permitted to make withdrawals from your 457 planUnlike other tax-deferred retirement plans such as IRAs or. However distributions received after the pensioner turned 59 12 would. Availability of statutory period to correct plan for failure to meet.

Withdrawals are subject to income tax. Contributions to a 457 b plan are tax-deferred. Yes a governmental 457 b.

457 Plan Meaning Retirement Plan Benefits Limits Vs 401k

457 B Retirement Plans Here S How They Work Bankrate

457 Plan Withdrawal Calculator

457 Contribution Limits For 2022 Kiplinger

Welcome Montgomery County Union Employees

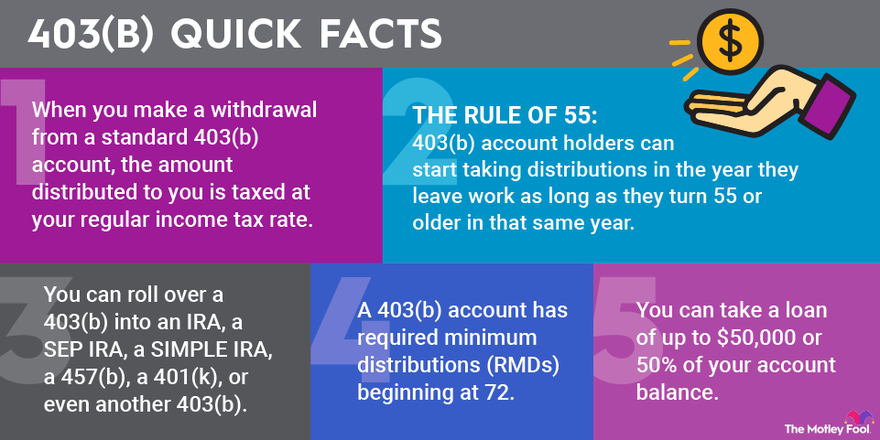

403 B Plan How It Works And Pros Cons The Motley Fool

457 Plan Meaning Retirement Plan Benefits Limits Vs 401k

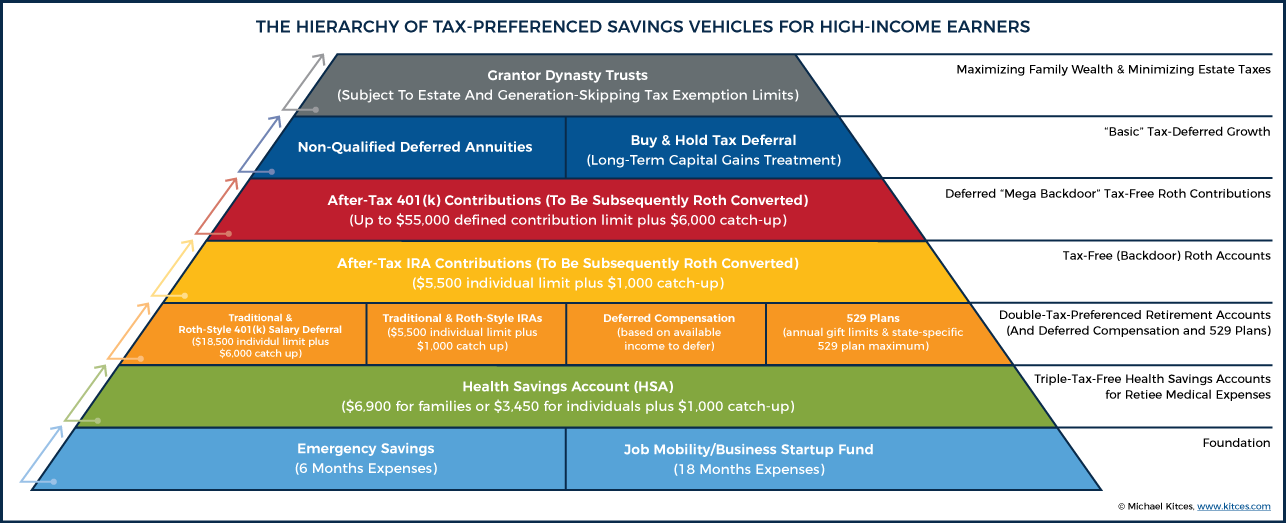

The Most Tax Efficient Sequence Of Withdrawal Strategy Explained Tan Wealth Management Certified Financial Planner Cfp San Francisco Advisor

A Guide To 457 B Retirement Plans Smartasset

A Guide To 457 B Retirement Plans Smartasset

457 Deferred Compensation Plan White Coat Investor

403 B 401 A And 457 Plans What S The Difference

457 Deferred Compensation Plan White Coat Investor

Sec 457 F Plans Get Helpful Guidance Journal Of Accountancy

Tax Deferred Vs Tax Free Investment Accounts David Waldrop Cfp

How To Utilize Your Non Governmental 457 B Plan White Coat Investor

Retirement Plan Required Minimum Distributions Rmds Moneytree Software